Project Bank Accounts – What Lies Ahead

01/12/2017

The new Building Industry Fairness (Security of Payment) Bill 2017 (Qld) was assented to on 10 November 2017, which will see the introduction of project bank accounts (PBAs) into the Queensland construction industry. As the project bank account provisions will be trialled from 1 January 2018, contractors, at least those involved in State Government projects, should familiarise themselves with the relevant provisions.

The new Building Industry Fairness (Security of Payment) Bill 2017 (Qld) was assented to on 10 November 2017, which will see the introduction of project bank accounts (PBAs) into the Queensland construction industry. As the project bank account provisions will be trialled from 1 January 2018, contractors, at least those involved in State Government projects, should familiarise themselves with the relevant provisions.

Ted Williams, Partner, Andrew MacGillivray, Senior Associate and Denise Burloff, Law Graduate discuss the PBA provisions contained in Chapter 2 of the new Building Industry Fairness (Security of Payment) Act (‘BIF Act’).

What Are Project Bank Accounts?

A PBA is a trust over:

1.amounts paid by the principal to the head contractor;

2.amounts payable by the head contractor to its subcontractors (ie. first tier subcontractors);

3.retention amounts withheld from first tier subcontractors; and

4.amounts in dispute.

Head contractors, in respect of applicable projects, will be responsible for establishing and administering these PBA’s (comprising a general trust account, retention account and disputed funds account) within the time stated in the contract or if not stated, within 20 business days after entering into the first subcontract. Failure to do so may result in a fine of up to $63,075.

Where Will Project Bank Accounts Apply?

Head contractors will be required to establish PBAs from 1 January 2018. PBAs will only be required for ‘PBA contracts’ and for which the head contractor engages subcontractors.

PBA contracts are building contracts:

- to which the State or a State authority requiring a PBA to be established is the principal;

- for which more than 50% of the contract price is for building work;

- for a contract price of between $1 million and 10 million; and

- where the building contract is not a subcontract for another building contract.

PBAs will not be required for residential construction work (except in limited circumstances) or maintenance work.

The Queensland Government has announced that PBA’s will also be required for private sector building contracts from 1 January 2019.[i]

How Will The Payment Process Change?

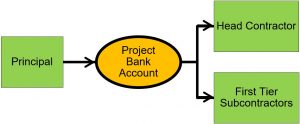

Rather than paying the head contractor, the principal will pay progress payments directly into the PBA. The head contractor will then distribute funds from the PBA to pay subcontractors amounts owing from it, and pay itself any amounts owing from the principal.

Payment process with a Project Bank Account

Where there is a shortfall in funds in the PBA to pay subcontractors, the head contractor will be required to deposit money into the PBA to cover the shortfall. Practically, if there is a shortfall, it is likely that the head contractor will dispute payments with its subcontractors in order to avoid depositing additional money into the PBA and being out of pocket.

How Will Project Bank Accounts Ensure Security Of Payment?

The intention behind the establishment of the PBA process is that amounts payable to subcontractors will be protected in the PBA if the head contractor becomes insolvent.

Insolvency

If a head contractor becomes insolvent, the principal is able to step in as trustee for the PBA. However, there is no mandatory requirement for the principal to do so. This will not secure payment in the instances where there is a payment dispute as subcontractors will still need to initiate court proceedings to recover disputed payments.

Given that the proceeds of PBAs will be payable to first tier subcontractors only (despite a large number of construction projects having sub-subcontractors, who in many cases are at most risk of suffering from cash flow issues), if a subcontractor becomes insolvent, its subcontractors will not be protected by the PBA.

Significantly, suppliers to projects (whether first tier or not) will receive no protection from PBAs as they will not be beneficiaries to PBAs. This excludes a large portion of the industry chain which, at times, may have contracts for values over that of some ‘first tier subcontractors’.

Preventing improper conduct by head contractors

PBAs also seem to ignore the reality that non-payment of subcontractors is not solely due to the insolvency of a contractor, but is predominantly due to payment disputes or improper conduct by the contractor.

The new BIF Act expressly prohibits head contractors from using funds from the PBA other than to pay it or its subcontractors, and restricts head contractors from paying itself if there are insufficient funds to pay both itself and the subcontractors. A breach of these requirements may result in a fine of up to $25,230 and $37,845 respectively. However, there is ultimately nothing expressly preventing a head contractor from paying itself in full before paying subcontractors (even where there are insufficient funds) or disputing payments with subcontractors in order to ensure it gets paid in full.

Although the principal will be given some access to the PBA, oversight will be limited to the extent it chooses to monitors the trust account (an additional increase to the contract administration cost). It is unclear at this stage to what extent the QBCC will audit compliance by head contractors of the PBA provisions.

In most cases, it will be up to subcontractors to sound the alarm that there is improper conduct by a head contractor.

Conclusion

Despite the good intention of the PBA provisions of the new BIF Act, the way in which PBAs will operate and the scope of PBA contracts and beneficiaries is likely to be too narrow to make a meaningful impact on security of payment in the construction industry.